MetaTrader 4 (MT4) has established it self as you of the most versatile and trusted trading programs for Forex and Contract for Variations (CFDs) enthusiasts. Introduced with the vision of empowering traders world wide, this software offers effective features catering to equally newcomers and seasoned professionals. With its cutting-edge instruments and user-friendly interface, Metatrader 4 continues to lead the package in the trading industry.

Why MetaTrader 4 is just a Go-To Choice for Traders

When selecting a trading system, usefulness and performance are key. MetaTrader 4 excels in these departments, rendering it the ultimate choice for trading Forex and CFDs. Here's why traders swear by its features:

1. User-Friendly Software

MetaTrader 4 is designed for easy navigation. Whether or not you're screening the waters of trading or are a seasoned expert, its spontaneous screen makes tasks like graph evaluation and buy performance effortless.

2. Sophisticated Charting and Analysis Tools

MT4 offers a comprehensive suite of planning instruments to greatly help traders produce data-driven decisions. With over 30 built-in specialized signals and custom resources to monitor price activities, predicting market tendencies hasn't been easier.

3. Specialist Advisors (EAs) for Automated Trading

One of MT4's standout characteristics is their support for Specialist Advisors. EAs permit automatic trading, enabling traders to set certain rules for articles and exits. Simplify your technique by letting MT4 execute trades as you concentrate on refining your methods.

4. Real-Time Information and Performance Tracking

Industry smarter with access to real-time industry data and in-depth performance analysis. That guarantees that you remain before industry movements and control your risks proactively.

Stay Forward with MetaTrader 4

From improved market option of bespoke charting features, MetaTrader 4 demonstrates exactly what a strong trading platform should be. It continues to conform to the powerful Forex and CFDs industries, giving traders an unparalleled experience.

Whether you're a new entrant to economic areas or even a skilled handling diverse portfolios, MetaTrader 4 gives the right blend of ease and sophistication.

++++++++++++++++++++++

How the MT4 Trading Platform Enhances Your Trading Strategy

============================

The planet of forex trading offers unparalleled options for financial development, but moving the market involves equally skill and the right tools. Among the most used methods for traders could be the mt4 trading platform. Noted for its versatility and advanced functionalities, this platform has become a staple for forex traders worldwide. But what makes MT4 so indispensable? Let's take a closer look.

Why MT4 may be the Go-To Program for Forex Traders

MT4, small for MetaTrader 4, is celebrated for its professional-grade functions used with user-friendly design. It suits equally novices dipping their toes into forex trading and experienced specialists managing delicate strategies.

Important factors for its reputation include:

1. Advanced Charting Tools

Traders rely seriously on specialized evaluation to make data-driven decisions. MT4 provides a comprehensive suite of charting tools that help customers to analyze value trends and identify opportunities. With customizable timeframes and technical indications, traders can simply fine-tune their graphs to match their trading strategy.

2. Specialist Advisors (EAs)

The MT4 software helps automated trading through their Expert Advisors feature. EAs support traders apply automatic methods, eliminating psychological decision-making and ensuring consistent execution. With this efficiency, you may even produce designed algorithms or download pre-designed kinds to match your trading goals.

3. Secure and Efficient Transactions

Safety is just a concern for traders, and MT4 doesn't disappoint. The software engages knowledge encryption to shield users' activities and resources, offering traders satisfaction while executing trades. Fast order delivery also guarantees that traders may make the most of essential market movements.

4. Multi-Device Compatibility

The forex market operates 24/5, and traders require freedom to act whenever possibilities arise. MT4 can be acquired on different units, including desktops, smartphones, and capsules, allowing consumers to control trades on the go.

The Benefits of Using MT4 in Forex Trading

Whether you're new to forex or an experienced trader, MT4's powerful features can enhance your trading knowledge by providing tools for greater decision-making, smooth performance, and more appropriate market analysis.

Start discovering the MT4 software today and observe how it can benefit you uncover the entire possible of forex trading.

++++++++++++++++

How CFD Trading Allows You Deal More Assets with Leverage

==========================

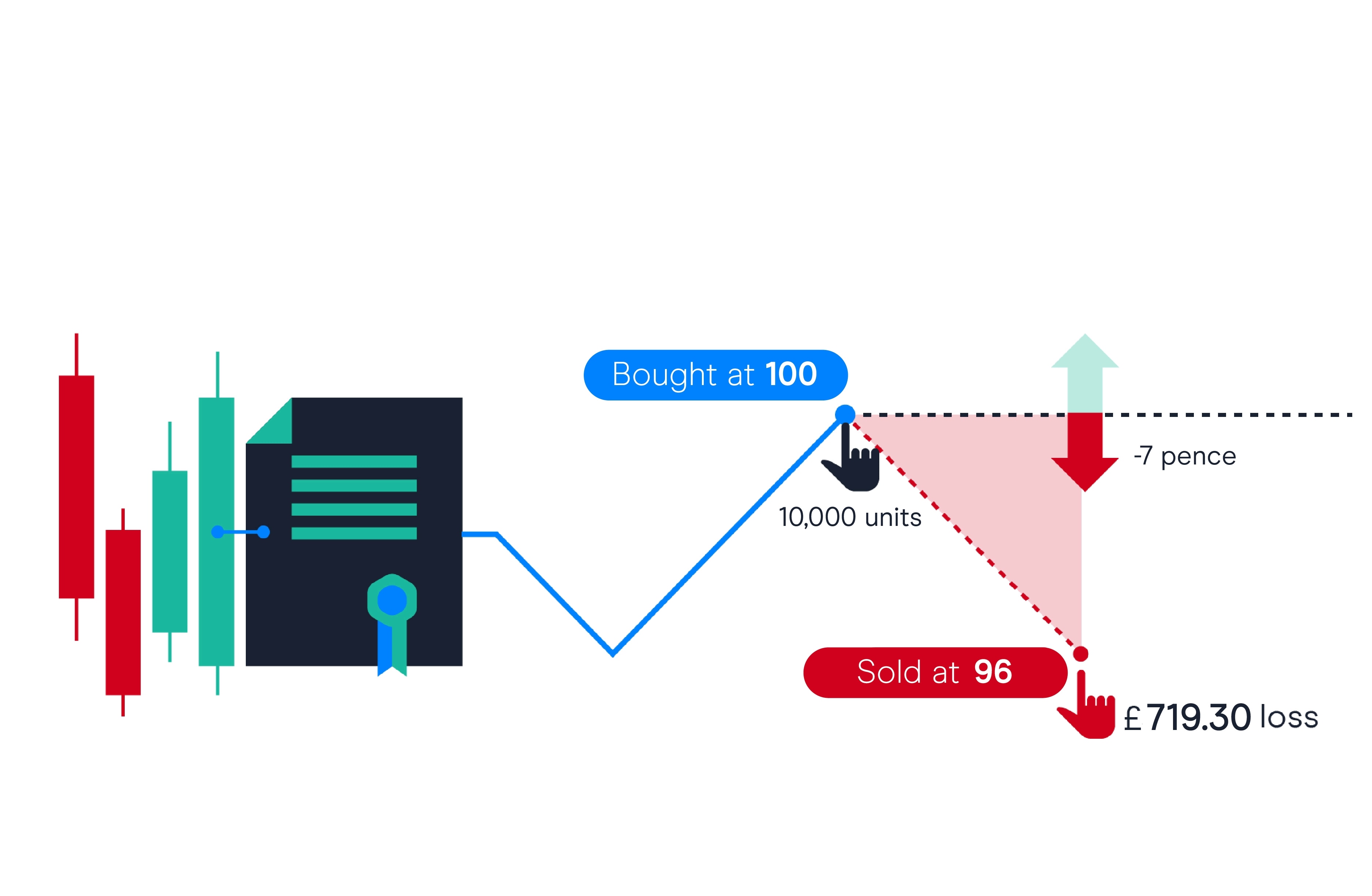

Agreement for Huge difference (CFD) trading has obtained acceptance among investors because of its flexibility and prospect of high returns. For those a new comer to the concept, CFDs are financial derivatives that allow you to imagine on the purchase price movement of various assets, such as for instance shares, commodities, forex, and indices, without really buying the underlying asset. This short article introduces the basics of cfd trading and presents ideas to help you begin your trading journey confidently.

What Precisely Is CFD Trading?

At their core, CFD trading requires buying and offering contracts that reveal the purchase price movement of an underlying asset. Once you enter a CFD position, you are essentially entering an agreement to switch the huge difference involving the asset's starting and ending price.

Unlike traditional investments, CFD trading provides you with the chance to gain even yet in downward markets. You are able to "move long" (buy) if you believe the advantage value may rise or "move short" (sell) if you expect a decline.

Key Advantages of CFD Trading

1. Control: CFD trading allows you to use leverage, meaning you only need to deposit a fraction of the trade's complete price as a deposit (referred to as margin). While this amplifies potential increases, in addition it raises the chance of loss.

2. Access to Numerous Markets: With CFDs, you are able to trade a range of advantage classes, including shares, commodities, currencies, and cryptocurrencies, all from one platform.

3. Hedging Opportunities: You can use CFDs to hedge your present account against possible losses in volatile markets.

Risks to Retain in Brain

Nevertheless CFD trading can be lucrative, it's important to method it with a definite knowledge of the risks. Leveraged trading implies that equally profits and losses are magnified. Also, industry volatility and sudden price actions can result in significant losses or even managed carefully.

Getting Began with CFD Trading

• Training First: Understand the fundamentals of trading and familiarize yourself with critical phrases like margin, leverage, and stop-loss orders.

• Practice: Most CFD programs offer demo accounts to greatly help traders exercise risk-free.

• Use Chance Management Tools: Set stop-loss and take-profit degrees for every deal to decrease your risks.

CFD trading offers a energetic method to engage with varied areas, but it needs cautious planning and strategy. By starting with a good basis of understanding and applying chance administration practices, new investors can uncover the possible that CFD trading offers.